UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

ConocoPhillips

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

20232024 Proxy

Statement

Table of Contents

| Stockholder Proposals | ||

| FOR | Item 4: Stockholder Proposal — Simple Majority Vote | 125 |

Cautionary Note Regarding Forward-Looking Statements

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our ESG goals, commitments, and strategies, including our net-zero commitments and other ESG related-related information. We use words such as “ambition,” “anticipates,” “believes,” “expects,” “future,” “goal,” “target,” “plan,” “must,” “will,” “should,” “aim,” “strive,” “intends,” and similar expressions to identify forward-looking statements. These statements involve risks and uncertainties. Actual results could differ materially from any future results expressed or implied by the forward-looking statements for a variety of reasons, including due to the risks and uncertainties that are discussed in our most recently filed periodic reports on Form 10-K and subsequent filings on Form 10-Qs, and Form 8-Ks. We assume no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Incorporation by Reference

To the extent that this Proxy Statement has been or will be specifically incorporated by reference into any other filing of ConocoPhillips under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, the sections of this Proxy Statement titled “Audit and Finance Committee Report” (to the extent permitted by the rules of the U.S. Securities and Exchange Commission (SEC)) and “Human Resources and Compensation Committee Report” shall not be deemed to be so incorporated, unless specifically stated otherwise in such filing. This Proxy Statement includes website addresses and references to additional materials found on those websites, which are provided for convenience only. These websites and materials are not incorporated into this Proxy Statement by reference.

A Message from Our Chairman and Chief Executive Officer and Lead Director

April 3, 20231, 2024

Dear Fellow Stockholders,

On behalf of the Board of Directors (the “Board”) and the Executive Leadership Team, we are pleased to invite you to participate in the 20232024 Annual Meeting of Stockholders (the “Annual Meeting”). The meeting will take place at the Hyatt Regency Houston West, 13210 Katy Freeway, Houston, Texas 77079,virtually on Tuesday, May 16, 2023,14, 2024, at 9:00 a.m. Central Daylight Time. There will be no in-person meeting. The attached Notice of the 20232024 Annual Meeting of Stockholders and Proxy Statement provideprovides information about the business we plan to conduct. Also, we wish to recognize one of our long-serving directors, Caroline Maury Devine, who will retire from the Board effective as of the Annual Meeting. We are grateful for her many years of exemplary service and valuable contributions to ConocoPhillips.

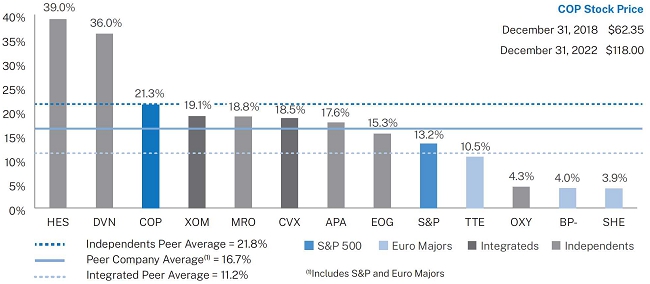

Celebrating 10 Years as an Independent E&P CompanyA Compelling 10-Year Plan

In 2022,At our 2023 Analyst & Investor Meeting, we celebrated thereaffirmed our durable returns-focused value proposition with an updated 10-year anniversary of the spin-off of our downstream business, a transaction designed to better positionfinancial plan that produces solid free cash flow, allowing us to pursue our focused business strategy as an independent explorationreward stockholders now and production (“E&P”) company. We are proud of how well we executed this vision, evolving into the company we are today. Over the past 10 years, we increased the size of our resource base while optimizing our portfolio. We did this not just through large transactions like the two we completed in 2021, but through continuous high-grading, bringing the average cost of supply of our portfolio down while reducing the emissions intensity of our operations. A decade after the spin, we are positioned to be the E&P company of choice through the energy transition –supplying energy to meet demand with a low cost of supply and low GHG intensity.future.

As we enter 2023,2024, ConocoPhillips continues to be guided by our Triple Mandate, which sets out three objectives to align our actions with the underlying realities of our business and demonstrates our commitment to create long-term value for our stockholders. First, we must reliably and responsibly deliver oil and gas production to meet energy transition pathway demand. Second, we must deliver competitive returns on and of capital for our stockholders. Third, we must remain focused on achieving our net-zero operational emissions ambition. Our Triple Mandate underlies our clearly defined value proposition of delivering superior returns through price cycles. We have improved our efficiencies and performance as we continue to executecycles based on our disciplined model for the business — focusing onfoundational principles of balance sheet strength, peer-leading distributions, maintaining a strong balance sheet, executing disciplined investment,investments, and demonstrating responsible and reliable ESGenvironmental, social and governance performance.

Continuing to Deliver on Each Pillar of theThe Triple Mandate

In 2022,2023, we continued to deliver on each of the three mandates:

| First, we achieved |

WeIn 2023, we delivered operationally across our diverse global diverse portfolio in 2022 with exceptional safety performance. After fully integrating the assets we acquiredrecord full-year production of 1,826 MBOED. We continued to leverage technologies and operational excellence to improve drilling and completion efficiencies in the Permian basin in 2021, Lower 48 achieved record production. In Norway, we progressed Tommeliten A and Eldfisk North projects. We achievedacross our assets. Our teams reached first oil production at Gumusutseveral subsea tiebacks in Norway, Surmont Pad 267 in Canada and Bohai Phase 34B in Malaysia,China and achieved startup at Fiord West Kuparuk in Alaska, and atthe second phase of Montney’s Pad 4central processing facility in Canada. We also progressedopportunistically acquired the remaining 50% working interest in Surmont at an attractive price that fits our financial framework. Long-life, low sustaining capital assets like Surmont play an important role in our low cost of supply portfolio. In addition, we reached final investment decision (FID) on Willow in Alaska, where we have over 50 years as a proven, responsible operator. Finally, we continued to advance our global LNG initiativestrategy through expansion in 2022 by expanding our LNG business in Australia, Germany, Qatar, and the U.S. In Australia, we acquired an additional 10 percent ownership in APLNG. In Germany, we executed a 15-year regasification agreementFID at the German LNG Terminal at Brunsbuttel. In Qatar, we were selected to participate in QatarEnergy’s North Field East and North Field South projects, and in the U.S., we entered into a 20-year sale and purchase agreement with Sempra Infrastructure for 5 million tonnes per annum of LNG offtake at the start-up of Phase 1 of the Port Arthur LNG, facility.regasification agreements in the Netherlands and offtake agreements in Mexico. We now have equity, offtake, and regasification agreements across major global markets.

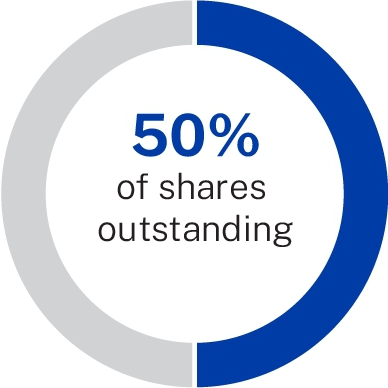

| Second, we returned $11 billion to stockholders and maintained discipline on our cost of supply framework with a continued focus on returns on and of capital. |

Full year 2023 earnings were $11.0 billion, or $9.06 per share, and our net cash provided by operating activities totaled $20.0 billion. We returned $11.0 billion to stockholders through our three-tier framework, including $5.6 billion through our ordinary dividend and variable return of cash and $5.4 billion in share repurchases. This is in excess of our annual through-the-cycle commitment to return greater than 30% of cash provided by operating activities to stockholders. In addition, across our portfolio we will acquire 30 percentmaintained discipline on our rigorous cost of the equity in Phase 1 of Port Arthur LNG.supply framework to maximize our returns on capital. We are enthusiastic about these new opportunitiesresolute in our efforts

| S |

|

| ||

| P |

|

| ||

| I |

|

| ||

| R |

|

| ||

| I |

|

| ||

| T |

|

| ||

4ConocoPhillips

A Message from Our Chairman and Chief Executive Officer and Lead Director

and excited to bring the expertise we developed during our 60+ years in the LNG business as we continue to believe that natural gas will be used in place of coal in the push for reduced global GHG emissions.

Full year 2022 earnings were $18.7 billion, or $14.57 per share, and our cash provided by operating activities totaled $28.3 billion. We returned $15 billion to stockholders through our three-tier framework, including $5.7 billion through our ordinary dividend and variable return of cash (VROC) and $9.3 billion in share repurchases, representing a return to stockholders of ~53 percent of cash provided by operating activities. In addition, across our portfolio we maintained discipline about our rigorous cost of supply framework to maximize our returns on capital. For example, as we integrated our new Permian assets acquired in 2021, we focused on maximizing efficiencies and optimizingoptimize well construction and completions designs to increase well recovery while minimizing incremental cost of supply. In addition,As an example, we executed multiple acreage swaps in theachieved improvement of completion pumping efficiencies by 10% to 15% across our Lower 48 to core up ~25,000 acres and provide over a year’s worth of additional two mile-plus lateral drilling inventory, further reducing our cost of supply. By maintaining discipline through our cost of supply framework, we act as responsible stewards of our stockholders’ capital.business segment.

| Third, we |

In 2022,2023, we publisheddemonstrated meaningful progress toward our Plan for the Net-Zero Energy Transition, (the “Plan”)including by accelerating our Scope 1 and 2 GHG emissions-intensity reduction target from 40-50% to provide50-60% gross operated emissions, using a 2016 baseline. We allocated a portion of our stockholders with an understandingbudget for projects to reduce our Scope 1 and 2 emissions intensity and advance low carbon opportunities, including carbon capture and storage. In addition, we are in our second year of membership in the valued role we intend to play in a well-managed and orderly energy transition, while sustaining our leadership as a best-in-class E&P company. We also joined the OGMPOil & Gas Methane Partnership 2.0 initiative. The mission of OGMP 2.0 is(OGMP 2.0) initiative, which seeks to improve industry transparency in methane emissions reporting and encourage progress in reducing those emissions. We believewere awarded the OGMP 2.0’s Gold Standard Pathway designation in recognition of our ambitious multi-year measurement-based reporting plan which goes beyond current regulatory requirements. Additionally, 2023 marked the first year that applying the rigorous OGMP 2.0 reporting standards across our global assets will beEnergy Transition Milestones were included as a vital step toward meeting the commitmentsstandalone metric in our Paris-aligned climate-risk framework, includingVariable Cash Incentive Program, further demonstrating our commitment to our net-zero ambition for operational emissions ambitions, by 2050. In addition, throughdirectly tying our participation with OGMP 2.0, we will be ableperformance on the Energy Transition Milestones to credibly demonstrate how we are delivering against our methane improvement objectives and targets, including the new 2030 methane emissions intensity target of approximately 0.15 percent of gas produced, which we set in October 2022. We are proud to continue to demonstrate our responsible and reliable ESG performance.

Positioned for the Futurecompensation.

Looking to the Future

Now and into the future, we are focused on operational excellence with a proven track record of strong returns. Our strategy is differential, and we believe our portfolio is the deepest, most durable and diverse of any of our peers. In addition, we are set upwell positioned for operational excellencethe energy transition. Safety remains a critical part of our culture, and will continuewe prioritize the safety of both our colleagues and communities. That means continuously looking for ways to operate more safely, efficiently, and responsibly, with a focus on ESG. In 2022, we welcomed our new Chief Diversity Officer and increased our reporting on our progress on diversity, equity, and inclusion. In addition, asreducing human error. We understand that this is a follow-up to the Plan we published last year, we have included on pages 15-16 a Progress Report to demonstrate how we are performing against the Plan. We pride ourselves on being accountable on the targets we have set. Guided by our Triple Mandate, we continue to raise the bar for ourselves and our industry. We expect 2023 to mark record production for ConocoPhillips since becoming an independent E&P company in 2012. We remain focused on delivering superior returns and have announced a 2023 planned return of capital to stockholders of $11 billion based on an $80 WTI framework. Finally, we continue to work toward our net-zero operational emissions ambition, including allocating a portionfundamental part of our budgetlicense to pursue projects to reduce our Scope 1 and 2 emissions intensity and to fund investments in several early-stage low-carbon opportunities that address end-use emissions.operate.

Your Input is Valued and Your Vote is Very Important

| Your input is valued and your vote is very important. |

We strongly believe that regular engagement with all of our stakeholders — stockholders, employees, customers, suppliers, advocacy groups, governments, and communities — is essentialcritical to our long-term success. The Annual Meeting is anotheran opportunity for stockholders to express their views on matters relating to ConocoPhillips’ business, and we hope to see you there.business.

Whether or not you plan to attendparticipate in the Annual Meeting, in person, and no matter how many shares you own, we encourage you to vote in advance. Your vote is important to us and to our business. Prior to the meeting, you may sign and return your proxy card, use telephone or Internet voting, or visit the Annual Meeting website at www.conocophillips.com/annualmeeting to register your vote. Instructions on how to voteVoting instructions begin on page 153132.

Thank you for your continued support.

|   | |

|  | |

Ryan M. Lance | Robert A. Niblock |

20232024 Proxy Statement5

Notice of 20232024 Annual Meeting of Stockholders

PROPOSALS REQUIRING YOUR VOTE

| Purpose | Purpose | Board Recommendation | Page | Purpose | Board Recommendation | Page |

| 1 | Election of 13 Directors | FOR each nominee | 17 | Election of 12 Directors | FOR each nominee | 16 |

| 2 | Ratification of Independent Registered Public Accounting Firm | FOR | 56 | Ratification of Independent Registered Public Accounting Firm | FOR | 62 |

| 3 | Advisory Approval of the Compensation of Our Named Executive Officers | FOR | 58 | Advisory Approval of the Compensation of Our Named Executive Officers | FOR | 64 |

| 4 | Advisory Vote on Frequency of Advisory Vote on Executive Compensation | Board expects to hold say-on-pay votes in accordance with the alternative that receives the most stockholder support | 59 | Stockholder Proposal – Simple Majority Vote | FOR | 125 |

| 5 | Adoption of Amended and Restated Certificate of Incorporation to Provide Stockholders with a Right to Call a Special Meeting | FOR | 128 | Stockholder Proposal – Revisit Pay Incentives for GHG Emission Reductions | AGAINST | 127 |

| 6 | Approval of 2023 Omnibus Stock and Performance Incentive Plan of ConocoPhillips | FOR | 130 | |||

| 7 | Stockholder Proposal – Independent Board Chairman | AGAINST | 138 | |||

| 8 | Stockholder Proposal – Share Retention Until Retirement | AGAINST | 142 | |||

| 9 | Stockholder Proposal – Report on Tax Payments | AGAINST | 144 | |||

| 10 | Stockholder Proposal – Report on Lobbying Activities | AGAINST | 147 | |||

Only stockholders of record at the close of business on March 20, 202318, 2024 will be entitled to receive notice of, and to vote at, the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by any stockholder at our offices in Houston, Texas during ordinary business hours for a period of 10 days prior to the meeting.

Visit our Annual Meeting website at www.conocophillips.com/annualmeeting to learn more about our Annual Meeting, review and download this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 20222023 (the “Annual Report”), submit questions in advance of the Annual Meeting, and sign up for electronic delivery of materials for future annual meetings.

April 3, 20231, 2024

By Order of the Board of Directors

ShannonKelly B. KinneyRose

Corporate Secretary

| |||

| DATE & TIME Tuesday, May | ||

|  | LOCATION

| www.virtualshareholdermeeting.com/COP2024 |

|  | RECORD DATE

| |

| 18, 2024 | |||

PARTICIPATE IN THE FUTURE OF CONOCOPHILLIPS—

VOTE NOW

| |||

| ONLINE

| ||

|  | PHONE CALL

| |

|  |

| |

|  |

| electronically. |

Your vote is very important to us and to our business. Even if you plan to attend the Annual Meeting, please vote right away. For more information on voting, please see “Available Information and Q&A About the Annual Meeting and Voting” beginning on page 130.

| Important Notice Regarding the Availability of Proxy Materials for the | |||

6ConocoPhillips

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. For more complete information regarding ConocoPhillips’ 20222023 performance, please review our Annual Report.

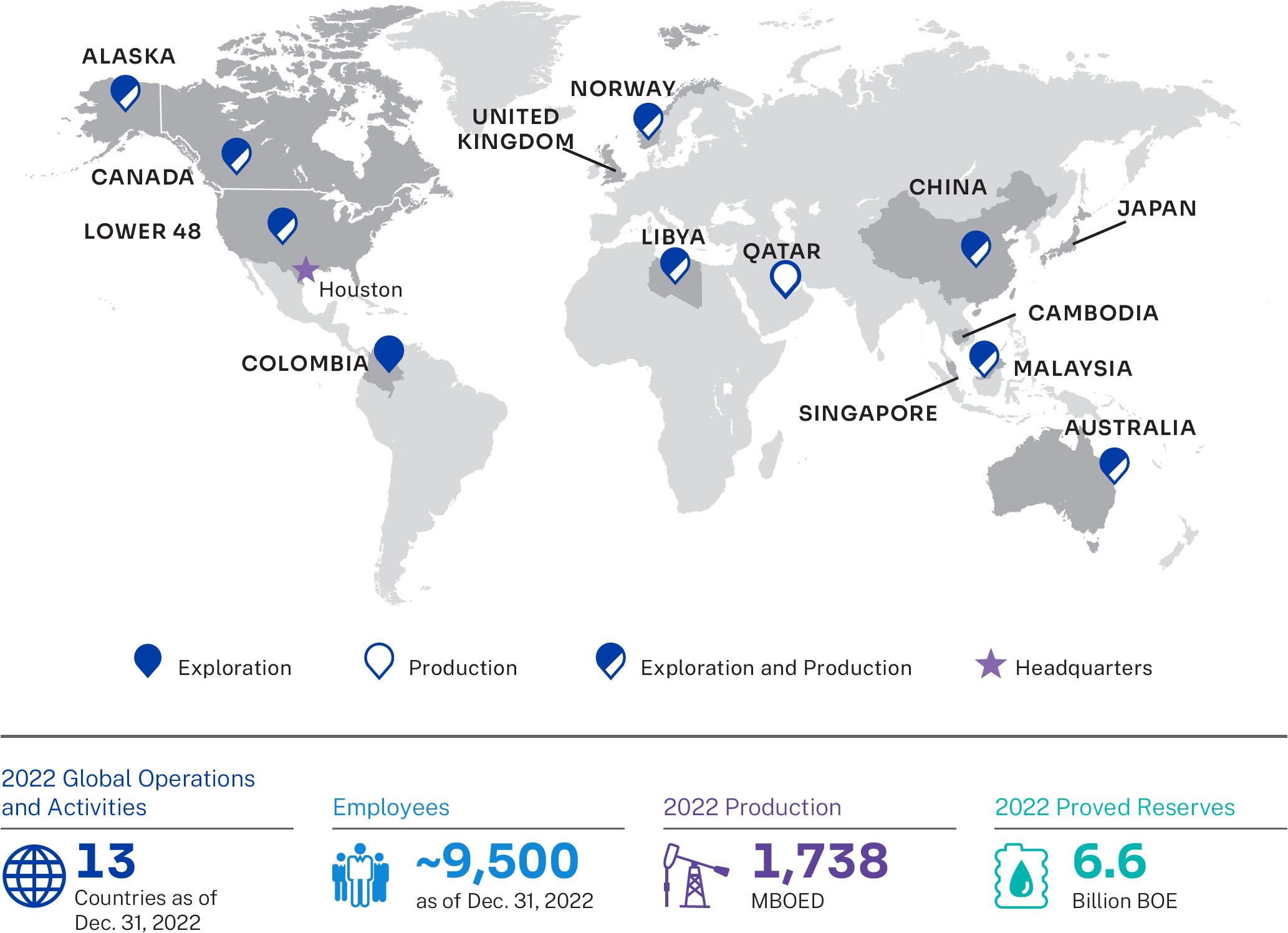

About ConocoPhillips

Company Overview

ConocoPhillips is one of the world’s leading exploration and production companies based on both production and reserves, with a globally diversified asset portfolio. Headquartered in Houston, Texas, as of December 31, 2022,2023, ConocoPhillips had operations and activities in 13 countries, $94$96 billion of total assets, and approximately 9,5009,900 employees. Production averaged 1,7381,826 thousand barrels of oil equivalent per day (“MBOED”) in 2022,2023, and proved reserves were 6.66.8 billion barrels of oil equivalent (“BBOE”) as of December 31, 2022.2023. We explore for, produce, transport, and market crude oil, bitumen, natural gas, LNG,NGLs and NGLsLNG on a worldwide basis. Our diverse, low cost of supply portfolio includes resource-rich unconventional plays in North America; conventional assets in North America, Europe, Africa and Asia; LNG developments; oil sands assets in Canada; and an inventory of global conventional and unconventional exploration prospects.

| CONOCOPHILLIPS IS ONE OF THE WORLD’S LEADING E&P COMPANIES BASED ON BOTH PRODUCTION AND RESERVES, WITH A GLOBALLY DIVERSIFIED ASSET PORTFOLIO. |

|

| 2023 Global Operations and Activities | Employees | 2023 Production | 2023 Proved Reserves | |||||||

| 13 Countries as of Dec. 31, 2023 |  | ~9,900 as of Dec. 31, 2023 |  | 1,826 MBOED |  | 6.8 Billion BOE | |||

CONOCOPHILLIPS IS ONE OF THE WORLD’S LEADING E&P COMPANIES BASED ON BOTH PRODUCTION AND RESERVES, WITH A GLOBALLY DIVERSIFIED ASSET PORTFOLIO.

20232024 Proxy Statement7

Proxy Summary

DeliveringExecuting on our Triple Mandate andReturns-Focused Value Proposition Drives Extraordinary Results for StockholdersDelivers Strong Financial and Operational Performance

In 2022,Throughout 2023, ConocoPhillips once again proveddemonstrated that we can deliver onstrong financial and operational performance consistent with our value proposition of superior returns to stockholders through price cycles while executing against our Triple Mandate to reliably and responsibly deliver oil and gas production to meet energy transition pathway demand, deliver competitive returns onand ofcapital to our stockholders, and achievefocus on achieving our net-zero operational emissions ambitions.

| ● | We |

| ● | We achieved a |

| ● | We |

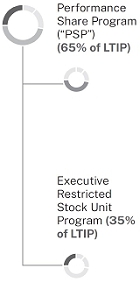

Importantly, we delivered these results while operating safelyWe continue to be guided by our SPIRIT Values and executing onremain committed to our foundational principles — focusing on peer-leading distributions, maintaining a strong balance sheet, executing disciplined investment, and demonstrating responsible and reliable ESG performance. Supporting these core principles are our strategic cash flow allocation priorities: (1) invest enough capital to sustain production and pay the existing dividend; (2) grow the dividend annually; (3) maintain ‘A’ credit rating; (4) return greater than 30 percent of cash from operations to stockholders; and (5) make disciplined investments to enhance returns.

We achievedA summary of the many important accomplishments we achieved in 2022, as2023 is shown below:

2022 HIGHLIGHTS — DELIVERING ACROSS ALL ELEMENTS OF THE TRIPLE MANDATE

| 2023 HIGHLIGHTS — DELIVERING ACROSS ALL ELEMENTS OF THE TRIPLE MANDATE |

| STRATEGY | FINANCIAL | OPERATIONS | |||||||

● $17.3B adjusted earnings; $13.52 adjusted EPS Acquired remaining 50% working interest in Surmont ● Progressed LNG strategy through expansion in Qatar, FID at PALNG, and regasification agreements in the Netherlands and offtake agreements in Mexico ● ●Accelerated GHG emissions-intensity reduction target through 2030(2) | ●Distributed ● ●Generated cash provided by operating activities of $20.0B; $21.3B CFO(3); $10.1B FCF(1); ending cash of |

●Announced 2024 expected | ●Delivered FY company and Lower 48 record production of ● Took FID on the Willow project ●

●Improved completion pumping efficiencies by 10-15% across the Lower 48 |

| (1) | Adjusted earnings, adjusted EPS, return on capital employed (ROCE), and free cash flow (FCF) are non-GAAP measures. Further information related to these measures as well as reconciliations to the nearest GAAP measure are included |

| (2) | Using a 2016 baseline. |

| (3) | Cash provided by operating activities was |

| Ending cash includes cash, cash equivalents, and restricted cash | |

8 ConocoPhillips

Proxy Summary

We maintained our ongoing practice of engaging with stockholders throughout 20222023 and received consistent feedback that our disciplined, returns-focused strategy is the right one for our business and that our stockholders appreciate our ongoing efforts to increase the transparency and robustness of our disclosures to address the things that they care about most.

8ConocoPhillips

Proxy Summary

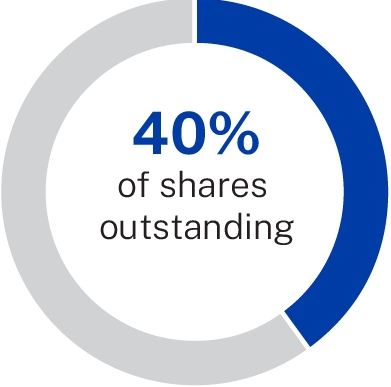

Stockholder Engagement

ConocoPhillips understands the importance of maintaining a robust stockholder engagement program. During 2022,2023, ConocoPhillips continued this long-standing practice. Executives and management from our investor relations, sustainable development, human resources, government affairs, and legal groups routinely engaged with stockholders on a variety of topics, including our strategy and value proposition, our success in integrating assets after completing two major acquisitions in 2021, corporate governance, implementation of a special meeting right, executive compensation, human capital management, culture, climate change, and sustainability. When appropriate, directors also met with stockholders. We spoke with representatives from our top institutional investors, mutual funds, public pension funds, labor unions, and socially responsible funds to hear their views on these important topics. Overall, investors expressed strong support for ConocoPhillips. We believe our regular stockholder engagement was productive and provided an open exchange of ideas and perspectives for both ConocoPhillips and our stockholders. For more information, see “Stockholder Engagement and Board ResponsivenessResponsiveness” ” beginning on page 4045 and “20222023 Say on Pay Vote Result, Stockholder Engagement, and Board ResponsivenessResponsiveness” ” beginning on page 6569.

20232024 Proxy Statement9

Proxy Summary

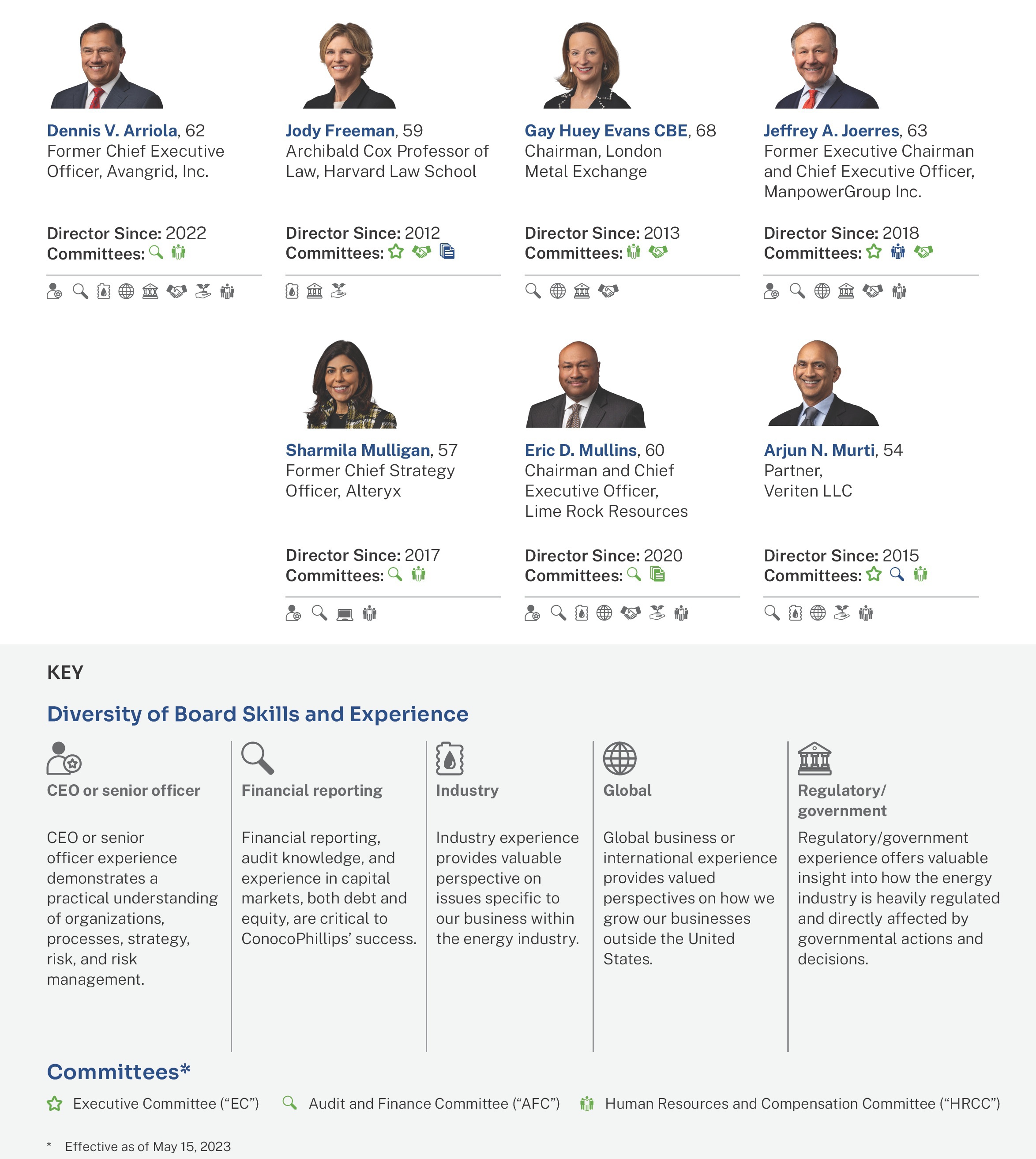

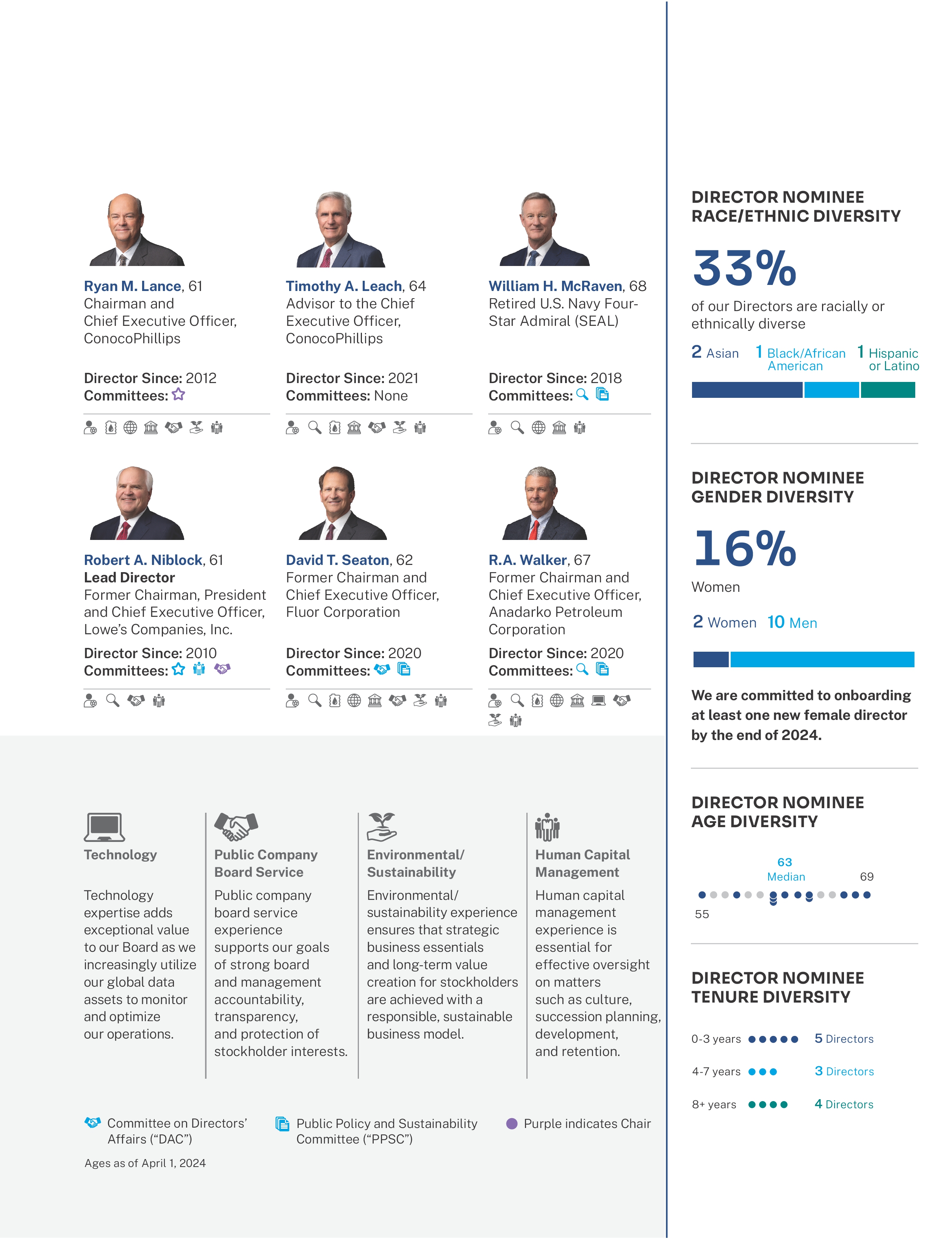

Director Nominees

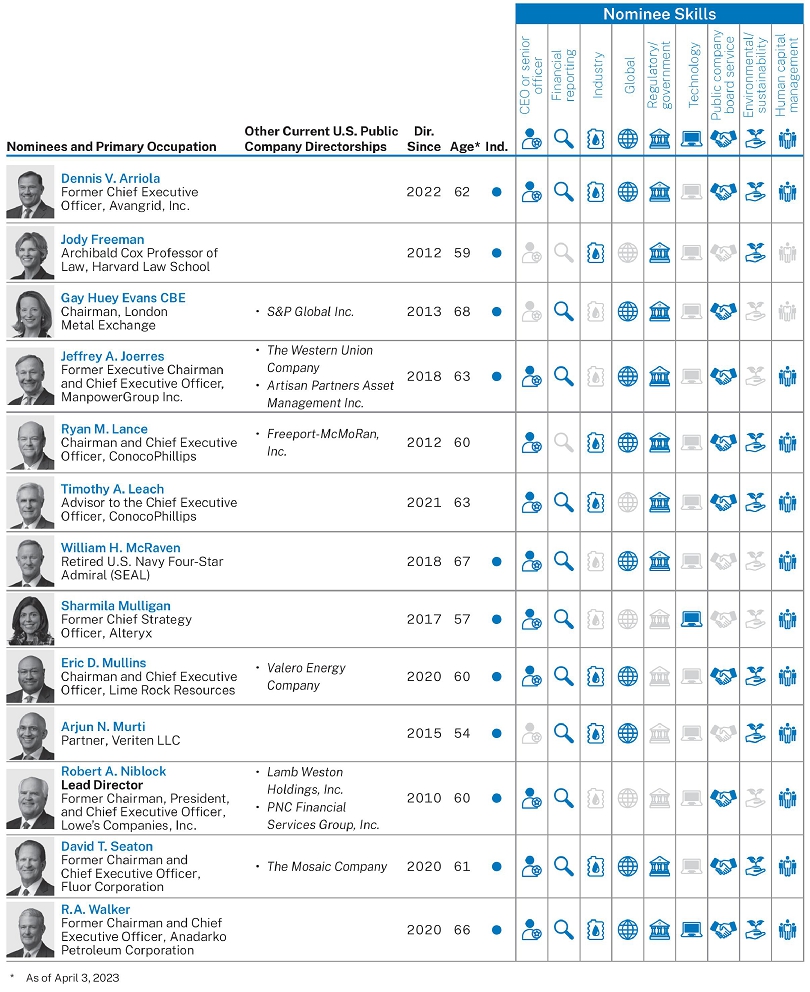

The Board recommends a vote FOReach of the 1312 nominees listed below. All of the nominees are currently serving as directors.

10ConocoPhillips

Proxy Summary

2024 Proxy Statement 11

Proxy Summary

2023 Proxy Statement11

Proxy Summary

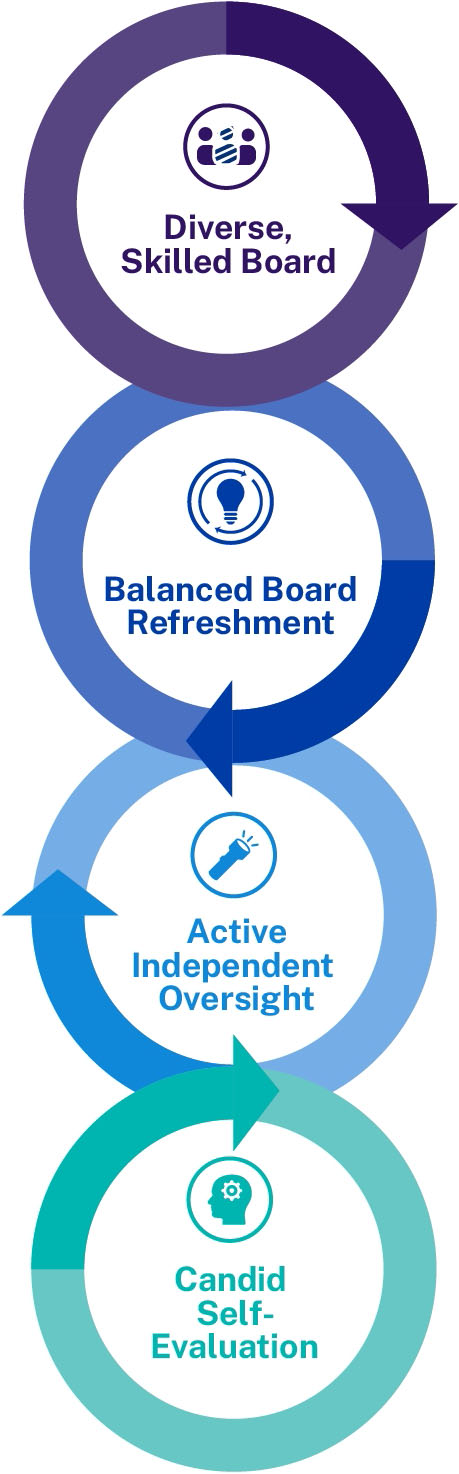

Governance Highlights

Our Board oversees the development and execution of our strategy. We have robust governance practices and procedures that support our strategy. To maintain and enhance independent oversight, our Board is focused on its composition and effectiveness and has implemented a number of measures for continuous improvement.

The measures outlined below align our corporate governance structure with our strategic objectives and enable the Board to effectively communicate and execute our culture of compliance and rigorous risk management.

COMPREHENSIVE, INTEGRATED GOVERNANCE PRACTICES

| ● | Our Board is committed to regular renewal and refreshment, and we continually assess whether our composition appropriately relates to ConocoPhillips’ current and evolving strategic needs. See “Board Composition and |

● | In assessing Board composition, the Committee on Directors’ Affairs considers any planned retirements from the Board, as well as background and diversity (including gender, ethnicity, race, national origin, and geographic background). | |

● | As a result, we have an experienced and diverse group of nominees. See “How Are Nominees Selected?” beginning on page | |

● | The Board balances its commitment to maintaining institutional knowledge with the need for fresh perspectives that board refreshment and director succession planning provide. | |

● | Our Board’s thorough onboarding and director education processes complement our recruitment process. See “Director Onboarding and | |

● | Our independent Lead Director’s robust duties are set forth in our Corporate Governance Guidelines. See “Board Leadership | |

● | Our non-employee directors meet privately in executive session at each regularly scheduled Board meeting. | |

● | Our Board reviews CEO and senior management succession and development plans at least annually and assesses candidates during Board and committee meetings and in less formal settings. | |

● | Our Board and committees conduct intensive and thoughtful annual evaluations of the Board, its committees, and its directors, including self-evaluations and peer assessments. See “Board and Committee | |

● | Our directors provide feedback on Board and committee effectiveness, including areas such as Board composition and the Board/management succession-planning process. | |

● | Our Board regularly assesses its leadership structure. | |

● | Our Board’s decision-making is informed by input from stockholders. |

| |||||

| |||||

●Annual election of all directors ●Long-standing commitment to sustainability ●Stock ownership guidelines for directors and executives ●Independent Audit and Finance, Human Resources and Compensation, Public Policy and Sustainability, and Directors’ Affairs committees ●Transparent public policy engagement ●Prohibition on pledging and hedging for all employees | ●Proxy access ●Active stockholder engagement ●Majority independent Board ●Executive sessions of non-employee directors held at each regularly scheduled Board meeting ●Empowered independent Lead Director ●Majority vote standard in uncontested elections ●Clawback Policy |

12ConocoPhillips

Proxy Summary

Executive Compensation

Executive Compensation Designed Around our Strategy and Informed by Stockholder Feedback

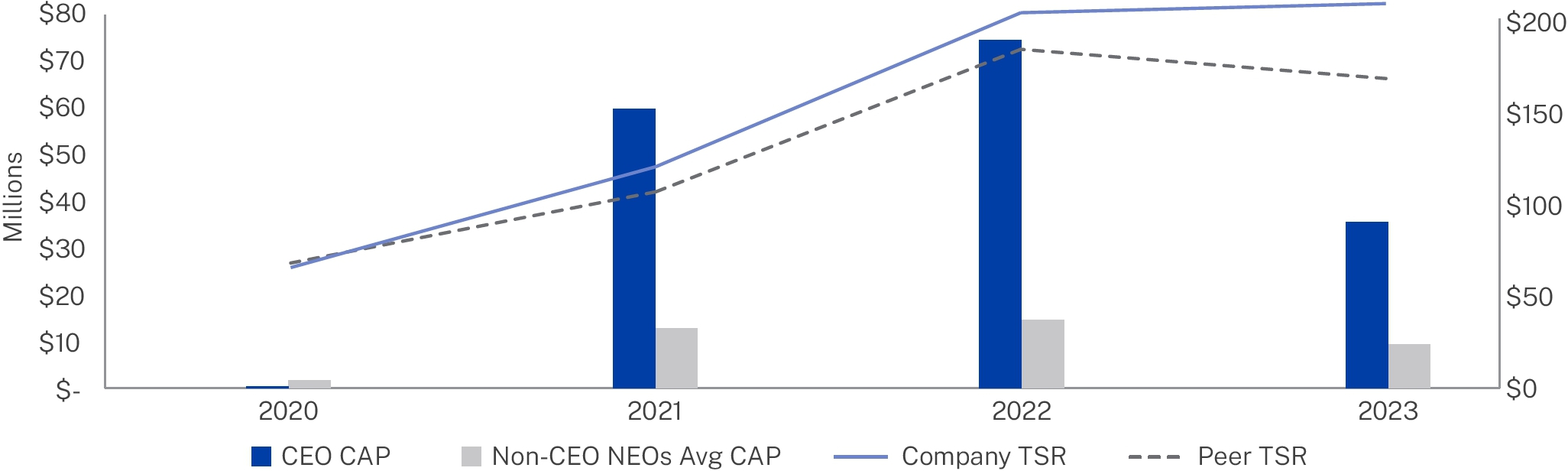

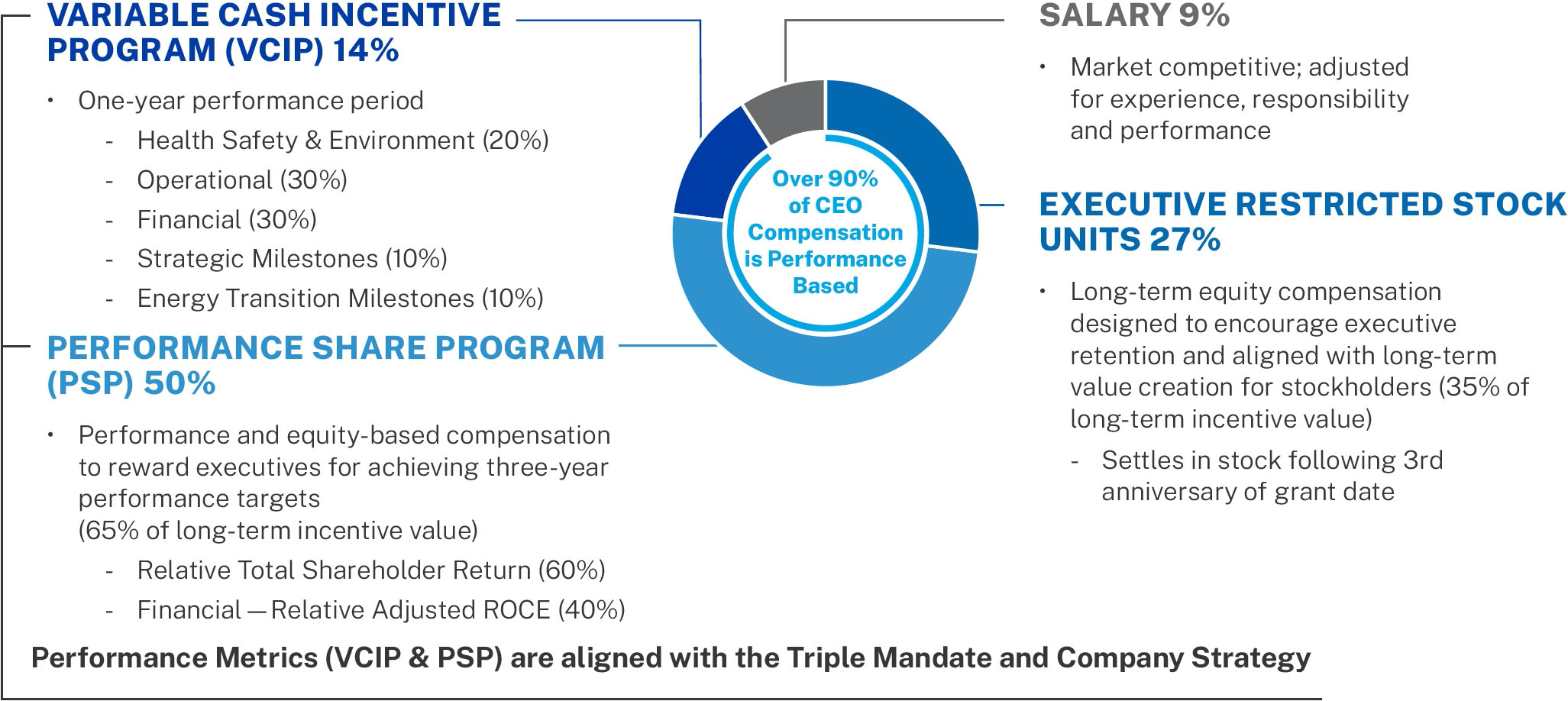

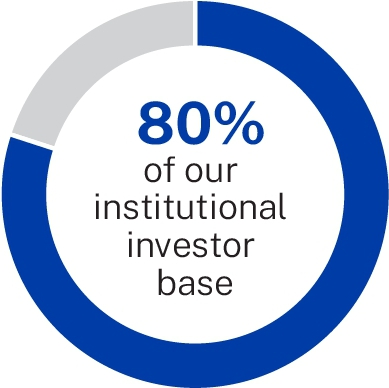

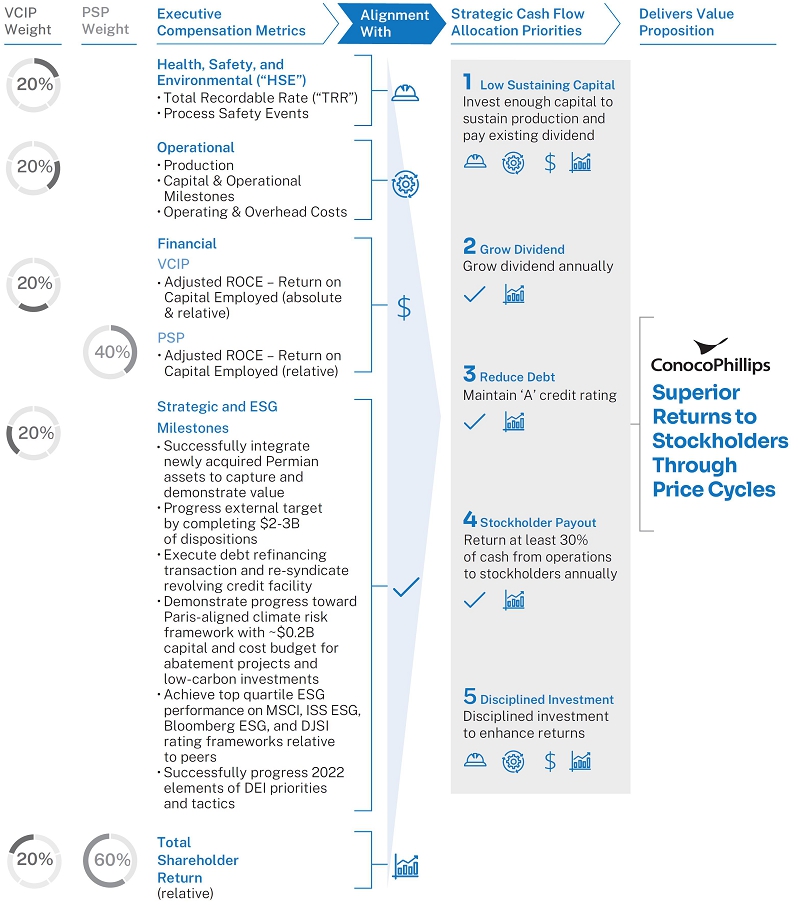

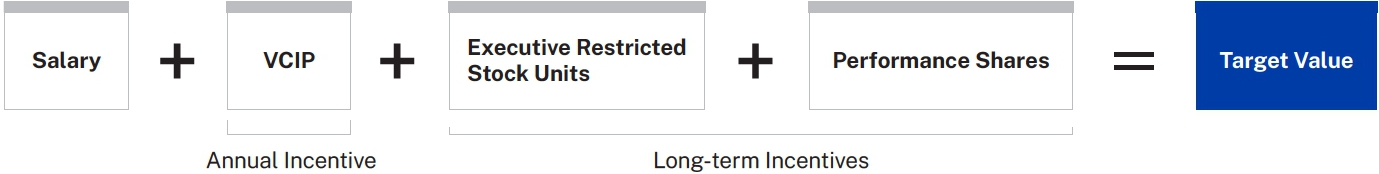

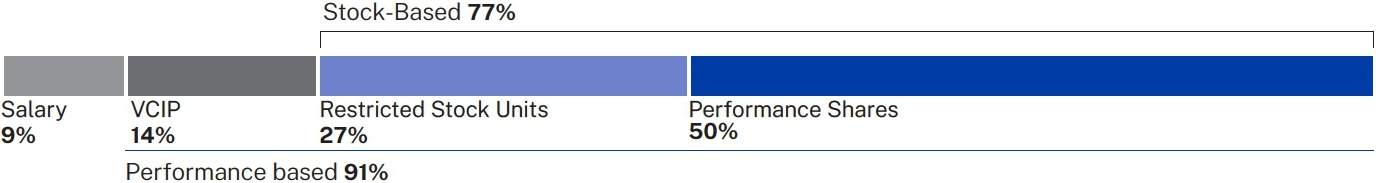

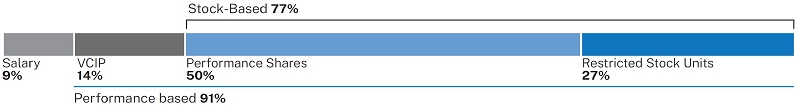

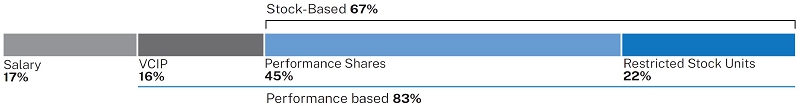

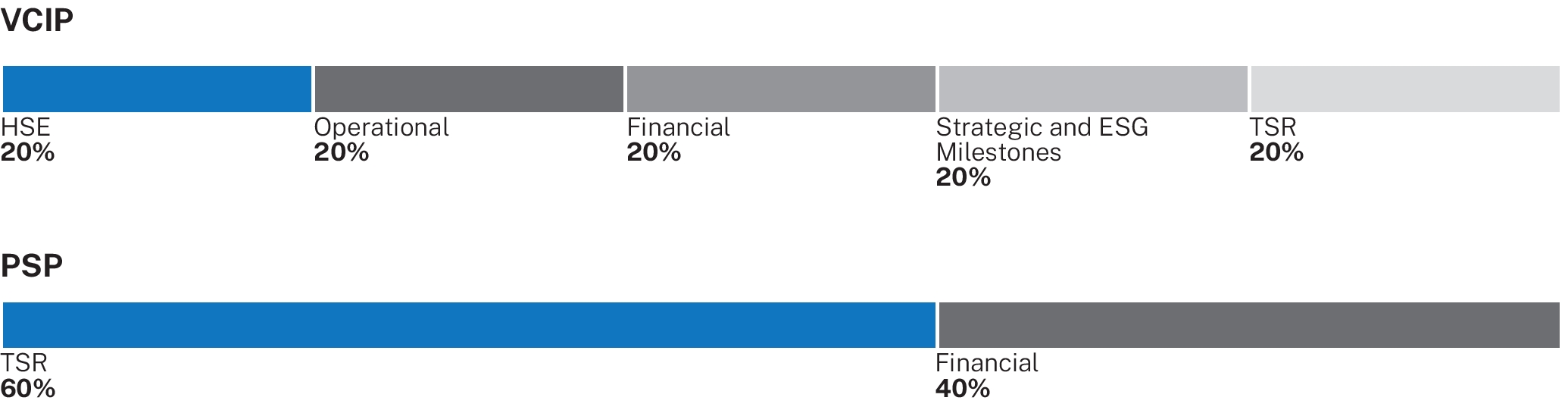

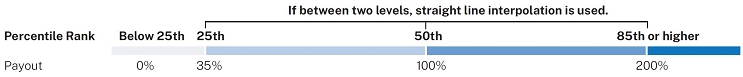

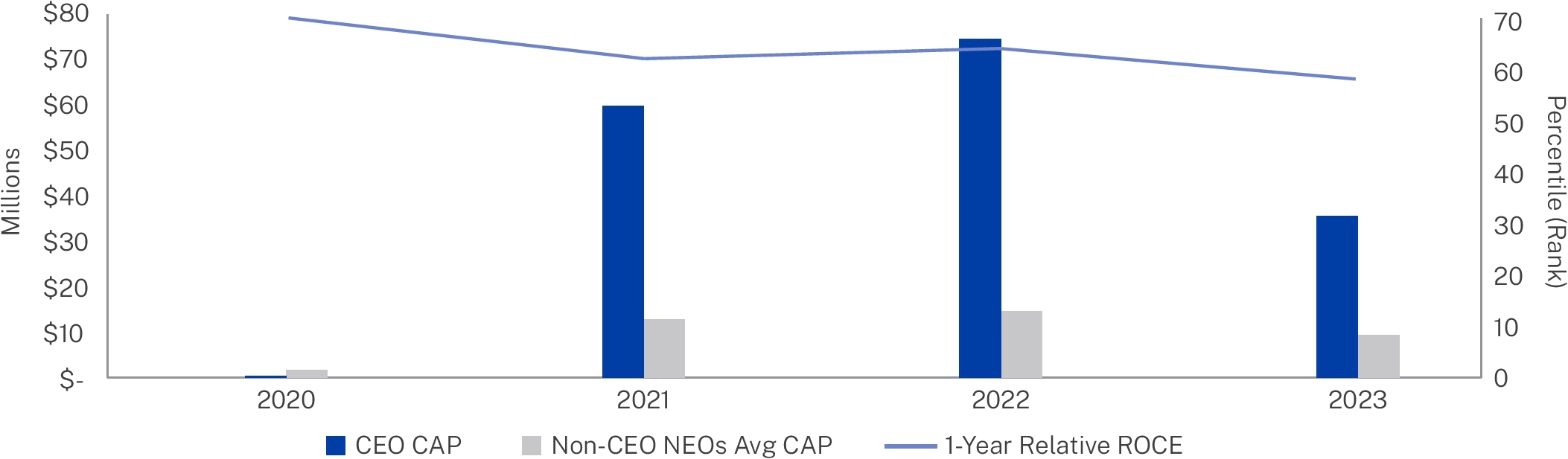

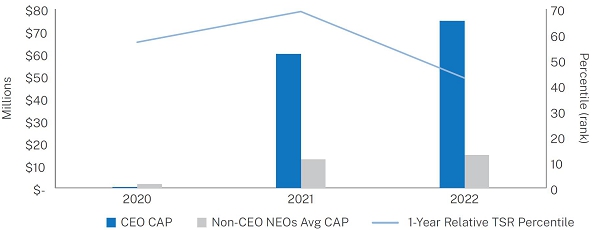

Our executive compensation programs and metrics remainare aligned with our Triple Mandate and are directly tiedtie to our strategic priorities (see page 7072). Historically,The following chart summarizes the principal components of our executive compensation programs have received strong stockholder support (averaging over 91 percent inprogram (percentages are shown for each component of our CEO’s 2023 target compensation).

Each year the three years priorHRCC, advised by its independent compensation consultant and informed by feedback from stockholders, undertakes a rigorous process to 2022). Whilereview our programs. The HRCC believes a substantial portion of our executive compensation should be equity-based and focused on rewarding long-term performance and furthermore, that this approach most closely aligns the 2022 say on pay vote passed (~60% voted in favor), the support was meaningfully lower than in prior years. As a result, when we metinterests of our top executives with those of our stockholders as part of our regular engagement process, we sought feedback to determine how best to respond to the lower say on pay support. We engaged with stockholders representing nearly 45 percent of outstanding stock and over 80% of our institutional investor base, and our Human Resources and Compensation Committee (HRCC) Chair, Jeffrey A. Joerres, was present in meetings with stockholders representing approximately 35 percent of ConocoPhillips’ outstanding stock.(see

| |||

|  |  |  |

During these engagements:page 67

The HRCC considered the feedback we received during engagement and after considerable deliberation, the HRCC determined the focus should be on continuous improvement within the current design of the programs, including taking action on opportunities for improvement that were raised by stockholders during engagement, as summarized below.

HRCC RESPONSES TO STOCKHOLDER FEEDBACK

Additional information about what we heard from stockholders and how we responded can be found on pages 65 - 66.

2023 Proxy Statement13

Proxy Summary

Compensation and Governance HighlightsPractices

Management and the HRCC believe pay and performance are best aligned through a rigorous reviewThrough our robust process of our executive compensation programs. This process, which is described under the heading “HRCC Annual Compensation CycleCycle” ” on page 7678, consists of benchmarking against our peers, completing four distinct performance reviews, incorporating stockholder feedback, and seeking the assistance of an independent third-party compensation consultant.

In connection with this ongoing review and based on feedback received through our stockholder outreach program, the HRCC maintains what it believes are besthas adopted strong governance practices for executive compensation. Below is a summary ofconsistent with the market, some of those practices.which are summarized below.

WHAT WE DO | ||

| ||

| ||

| ||

| ||

|  Payouts capped on executive incentive programs Payouts capped on executive incentive programs ESG and Human Capital metrics tied to executive and employee compensation (see page ESG and Human Capital metrics tied to executive and employee compensation (see page | |

| ||

| Executives’ incentive compensation subject to clawback policy (see page 95) | |

| WHAT WE DON’T DO | ||

| No excise tax gross-ups for change in control plan participants | |

| No current payment of dividend equivalents on unvested long-term incentives for executives | |

| No repricing of stock options | |

| No pledging, hedging, short sales, or derivative transactions | |

| No employment agreements for our named executive officers (“NEOs”) Don’t reward executives for excessive, inappropriate or unnecessary risk-taking Don’t reward executives for excessive, inappropriate or unnecessary risk-taking |

2024 Proxy Statement14 13

ConocoPhillips

Progress Report on Our Plan for the Net-Zero Energy Transition

Since publishing our Plan for the Net-Zero Energy Transition in 2022 (our “Plan”), we have continued to focus on implementing our Climate Risk Strategy and advancing the objectives that were first outlined in the Plan.Plan’s objectives. Our commitment to these efforts is demonstrated by our achievements made to date — many of which have been completed ahead of schedule. As we achieve our goals, we fine-tune our strategy and refine our commitments to demonstrate adaptability, accountability andthrough ongoing alignmentengagement with the aims of the Paris Agreement.our key stakeholders.

The table below is meant to provideprovides an update on how we are progressing against our Plan, including demonstrating our progress and achievements in maintaining strategic flexibility, reducing Scope 1 and 2 emissions, our efforts to addressaddressing Scope 3 emissions as well as our contributionsand contributing to the energy transition.

|

|  | ● ●

| |

|   |

●Reduced methane intensity by ~70% since ● ● ●Invested in LongPath Technologies, a scalable laser-based continuous emissions monitoring solution with the potential to cover targeted assets or provide basin-wide multi-operator coverage. | |

| ●On schedule to meet the World Bank Zero Routine Flaring goal by ● | ||

| ● ●

●Participated in a Ceres-led Roundtable to discuss solutions for reaching net-zero emissions with cross-sector participation from the financial sector and ●

● ●Chaired a National Petroleum Council study on | ||

|  | ● ●Increased our investment in the Climate Asset Management Carbon Fund. ●Continued to evaluate a wide range of future offset projects and funds |

| (1) | Per the World Bank’s Zero Routine Flaring by 2030 Initiative Text, “Oil companies that endorse the Initiative will develop new oil fields they operate according to plans that incorporate sustainable utilization or conservation of the field’s associated gas without routine flaring. Oil companies with routine flaring at existing oil fields they operate will seek to implement economically viable solutions to eliminate this legacy flaring as |

2023 Proxy Statement14 15ConocoPhillips

Progress Report on Our Plan for the Net-Zero Energy Transition

|   | ●Expanded policy advocacy beyond carbon pricing to include ●

| |

| ●

●

| ||

| ● ● ●Signed offtake agreements | ||

| ● ● ● | ||

| ●

|

We acknowledge the findings of the Intergovernmental Panel on Climate Change that GHG emissions from the use of fossil fuels contribute to increases in We have had a public global climate change position since 2003. The position is reviewed periodically, agreed to by the Executive Leadership Team, and then recommended to the Board. |

2024 Proxy Statement

We acknowledge the findings of the Intergovernmental Panel on Climate Change that GHG emissions from the use of fossil fuels contribute to increases in global temperatures. We acknowledge the importance that current science places on limiting global average temperature increases to below 2-degree Celsius compared to pre-industrial times, and to achieve that, current science shows that global GHG emissions need to reach net-zero in the second half of this century. We support the Paris Agreement as a welcomed global policy response to that challenge.

We have had a public global climate change position since 2003. The position is reviewed periodically, agreed to by the Executive Leadership Team, and then recommended to the Board.

16 15ConocoPhillips

Item 1: Election of Directors and

| What am I Voting On? | |

| You are voting on a proposal to elect the | ||

What is the makeup of the Board of Directors and how often are the members elected?

Our Board currently has 1412 members. The size of the Board is expected to be reduced to 13 members when Ms. Devine retires at the Annual Meeting. Directors are elected at the annual stockholder meeting each year. Any vacancy on the Board created between annual stockholder meetings (if, for example, a current director resigns or the size of the Board is increased) may be filled by a majority vote of the remaining directors then in office. Any director appointed to fill a vacancy would hold office until the next election.

Under our Corporate Governance Guidelines, directors generally may not stand for reelection after they reach the age of 72.

What if a nominee is unable or unwilling to serve?

All director nominees have consented to serve. However, should a director become unable or unwilling to serve before the date of the Annual Meeting and should the Board not elect to reduce the size of the Board, shares represented by proxies may be voted for a substitute nominated by the Board.

How are directors compensated?

Please see our discussion of non-employee director compensation beginning on page 4953.

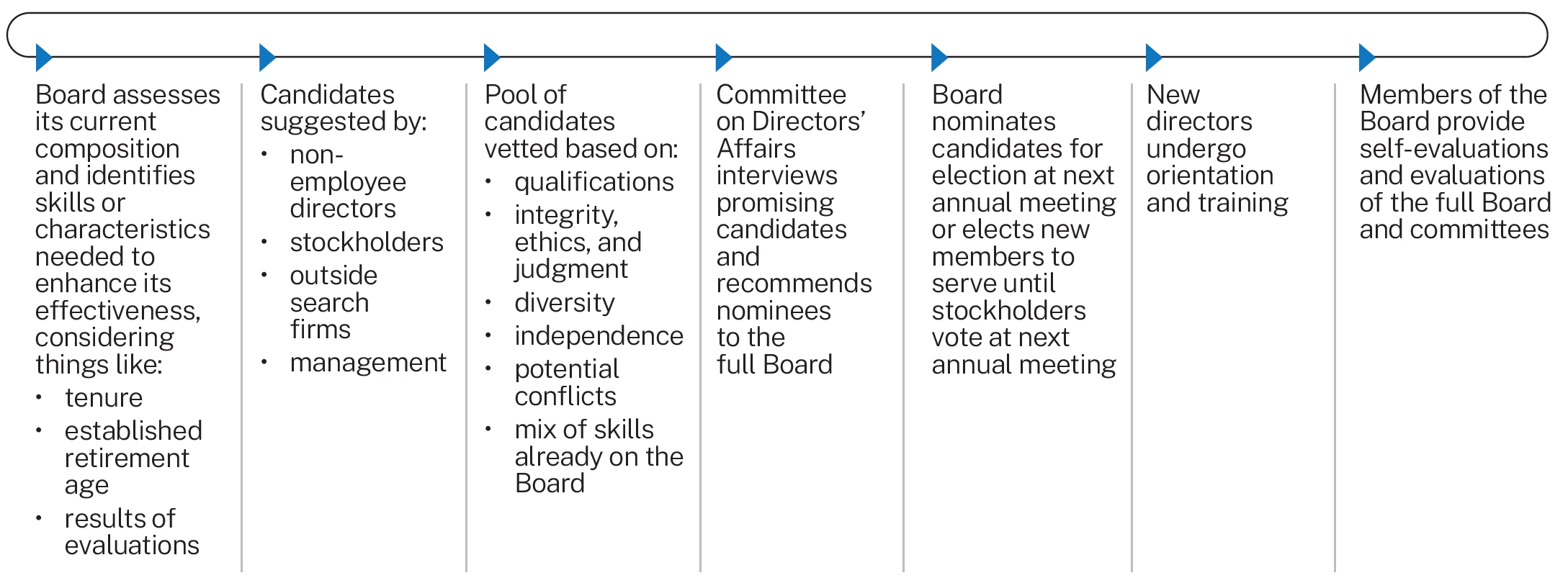

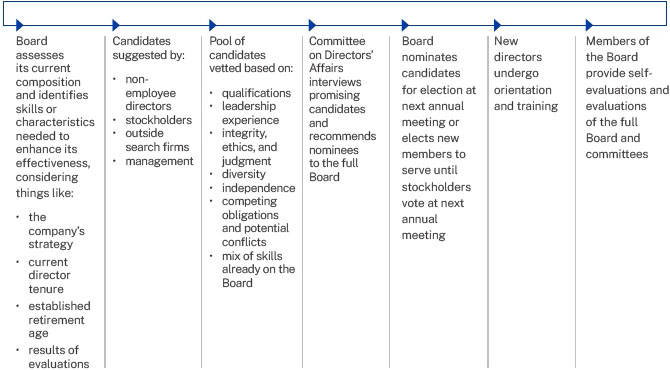

How are nominees selected?

The Committee on Directors’ Affairs regularly evaluates the size and composition of the Board and continually assesses whether the composition appropriately relates to ConocoPhillips’ strategic needs, which change as the business environment evolves. We seek director candidates who possess the highest personal and professional ethics, integrity, and values and who are committed to representing the long-term interest of all ConocoPhillips’ stakeholders. As some directors approach retirement age, the Committee on Directors’ Affairs seeks to onboard new directors to backfill the needed skills and experience of outgoing directors with sufficient overlap in service to allow for the transfer of institutional knowledge and sharing of experiences.

2023 Proxy Statement16 17ConocoPhillips

Item 1: Election of Directors and Director Biographies

The chart below shows our process for identifying and integrating new directors.

| HOW WE SELECT AND ONBOARD/INTEGRATE NEW BOARD MEMBERS |

HOW WE SELECT AND ONBOARD/INTEGRATE NEW BOARD MEMBERS

Our Corporate Governance Guidelines contain director independence standards consistent with the standards prescribed in the NYSE Listed Company Manual and provide that, at all times, at least a substantial majority of the Board must meet those standards. The Committee on Directors’ Affairs also seeks to ensure that the Board reflects a range of talents, ages, skills, personal attributes, and expertise — particularly in the areas of leadership and management, financial reporting, issues specific to oil- andoil-and gas-related industries, both domestic and international markets, public policy and government regulation, technology, public company board service, human capital management, and environmental and sustainability matters — sufficient to provide sound and prudent guidance with respect to ConocoPhillips’ strategic needs. The Board seeks to maintain a diverse membership and also requires that its members be able to dedicate the time and resources necessary to ensure the diligent performance of their duties, including attending Board and applicable committee meetings. To that end, the Committee on Directors’ Affairs considers the number of other boards on which each candidate already serves. Non-employee directors may not serve on more than four other boards of publicly-traded companies in addition to the Board, and ConocoPhillips' Chief Executive Officer may not serve on the board of more than one other publicly-traded company. Directors should seek approval from the Chair of the Board and the Chair of the Committee on Directors’ Affairs in advance of accepting an invitation to serve on another public company board.

2024 Proxy Statement18 17ConocoPhillips

Item 1: Election of Directors and Director Biographies

The following are some of the key qualifications and skills the Committee on Directors’ Affairs considered in evaluating the director nominees. The chart on the next page shows how these qualifications and skills are distributed among our nominees. The individual biographies beginning on page 2221 provide additional information about how each nominee’s specific experiences, qualifications, and skills align with and further the strategic direction of ConocoPhillips.

| CEO |   |   | |||||||

| We believe that directors with CEO or senior officer experience provide valuable insights. These individuals have a demonstrated record of leadership and a practical understanding of organizations, processes, strategy, risk and risk management, and the methods to drive change and growth. Through their service as top leaders at other companies, they also bring valuable perspectives on common issues affecting large and complex organizations. | We measure operating and strategic performance by reference to financial targets. In addition, accurate financial reporting and robust auditing are critical to ConocoPhillips’ success. Accordingly, we seek to have a number of directors who could qualify as audit committee financial experts (as defined by SEC rules), and we expect all of our directors to be financially knowledgeable. We also believe it is important to have knowledge and experience in capital markets, both debt and equity, given our position as a large publicly traded company. | We seek to have directors with significant experience in the energy industry. These directors have valuable perspective on issues specific to our business. | ||||||||

|   |   | ||||||||

| As a global energy company, our future success depends, in part, on how we grow our businesses outside the United States. Directors with global business or international experience provide valued perspectives on our operations. | The perspectives of directors who have experience within the regulatory field are important. The energy industry is heavily regulated and directly affected by governmental actions and decisions, and we believe that directors with government experience offer valuable insight in this regard. | Experience or expertise in information technology helps us pursue and achieve our business objectives. Leadership and understanding of technology, cybersecurity risk, cloud computing, scalable data analytics, and big data technologies add exceptional value to our Board as we increasingly utilize our global data assets to monitor and optimize our operations. | ||||||||

| BOARD SERVICE |   | SUSTAINABILITY |   | MANAGEMENT | |||||

| ConocoPhillips aspires to the highest standards of corporate governance and ethical conduct. Service on the boards and board committees of other large, publicly traded companies provides an understanding of corporate governance practices and trends and insights into: (1) board management; (2) relations between the Board, the CEO, and senior management; (3) agenda setting; and (4) succession planning. We believe this experience supports our goals of strong board and management accountability, transparency, and protection of stockholder interests. | We could not execute our differential strategy without employees, which is why we value directors with experience in effectively engaging, developing, retaining, and rewarding employees and with experience in diversity, equity, and inclusion management. | |||||||||

2023 Proxy Statement18 19ConocoPhillips

Item 1: Election of Directors and Director Biographies

NOMINEE SKILLS MATRIX

| Nominee Skills | ||||||||||||||

|  |  |  |  |  |  |  |  | ||||||

| Nominees and Primary Occupation | Other Current U.S. Public Company Directorships | Dir. Since | Age* | Ind. |  |  |  |  |  |  |  |  |  | |

| Dennis V. Arriola Former Chief Executive Officer, Avangrid, Inc. | ●Commercial Metals Company ●Meritage Homes Corporation | 2022 | 63 | ● |  |  |  |  |  |  |  |  |  |

| Gay Huey Evans CBE Former Chairman, London Metal Exchange | ●S&P Global Inc. | 2013 | 69 | ● |  |  |  |  |  |  |  |  |  |

| Jeffrey A. Joerres Former Executive Chairman and Chief Executive Officer, ManpowerGroup Inc. | ●Artisan Partners Asset Management Inc. ●The Western Union Company | 2018 | 64 | ● |  |  |  |  |  |  |  |  |  |

| Ryan M. Lance Chairman and Chief Executive Officer, ConocoPhillips | ●Freeport-McMoRan, Inc. | 2012 | 61 |  |  |  |  |  |  |  |  |  | |

| Timothy A. Leach Advisor to the Chief Executive Officer, ConocoPhillips | 2021 | 64 |  |  |  |  |  |  |  |  |  | ||

| William H. McRaven Retired U.S. Navy Four-Star Admiral (SEAL) | 2018 | 68 | ● |  |  |  |  |  |  |  |  |  | |

| Sharmila Mulligan Former Chief Strategy Officer, Alteryx | 2017 | 58 | ● |  |  |  |  |  |  |  |  |  | |

| Eric D. Mullins Chairman and Chief Executive Officer, Lime Rock Resources | ●Valero Energy Company | 2020 | 61 | ● |  |  |  |  |  |  |  |  |  |

| Arjun N. Murti Partner, Veriten LLC | 2015 | 55 | ● |  |  |  |  |  |  |  |  |  | |

| Robert A. Niblock Lead Director Former Chairman, President, and Chief Executive Officer, Lowe’s Companies, Inc. | ●Lamb Weston Holdings, Inc. ●PNC Financial Services Group, Inc. | 2010 | 61 | ● |  |  |  |  |  |  |  |  |  |

| David T. Seaton Former Chairman and Chief Executive Officer, Fluor Corporation | ●The Mosaic Company | 2020 | 62 | ● |  |  |  |  |  |  |  |  |  |

| R.A. Walker Former Chairman and Chief Executive Officer, Anadarko Petroleum Corporation | 2020 | 67 | ● |  |  |  |  |  |  |  |  |  | |

| * | As of April 1, 2024 |

2024 Proxy Statement20 19ConocoPhillips

Item 1: Election of Directors and Director Biographies

Generally, the Committee on Directors’ Affairs identifies candidates through business and organizational contacts of the directors and management, though third-party search firms occasionally assist as well. Stockholders are also welcomed to recommend director candidates for consideration. If you wish to recommend a candidate for nomination to the Board, please follow the procedures described under “Submission of Future Stockholder Proposals and NominationsNominations” ” on page 150129 for nominations made directly by a stockholder. Candidates recommended by stockholders are evaluated on the same basis as all other candidates.

After the 2022 Annual Meeting of Stockholders, at which 12 of the 13 current nominees for directors were elected, the Committee on Directors’ Affairs recommended and the Board concurred in electing Mr. Dennis V. Arriola to the Board effective September 13, 2022. Mr. Arriola was identified as part of the Committee of on Directors’ Affairs regular process for identifying potential director nominees. Mr. Arriola was identified by global executive search firm, Heidrick & Struggles.

What vote is required to approve this proposal?

Each nominee requires the affirmative vote of a majority of the votes cast at the Annual Meeting; the number of votes cast “for” a director must exceed the number of votes cast “against” that director. In a contested election (if the number of nominees exceeded the number of directors to be elected), directors would be elected by a plurality of the shares represented at the meeting and entitled to vote on the election of directors.

What if a Director Nominee does not receive a majority of the votes cast?

If a nominee who is serving as a director is not elected at the Annual Meeting and no one else is elected in place of that director, then, under Delaware law, the director continues to serve on the Board as a “holdover director.” However, under our By-Laws, a holdover director is required to tender a resignation to the Board. The Committee on Directors’ Affairs then would consider the resignation and recommend to the Board whether to accept or reject it or whether some other action should be taken. The Board would then make a decision, without participation by the holdover director. The Board is required to disclose publicly (by a news release, filing with the SEC, or other broadly disseminated means of communication) its decision regarding the tendered resignation and the rationale behind that decision within 90 days from the date the election results are certified.

2023 Proxy Statement20 21ConocoPhillips

Item 1: Election of Directors and Director Biographies

Who are this year’s Director Nominees?

The following 1312 directors are standing for election to hold office until the 20242025 Annual Meeting of Stockholders. Each of the director nominees is a current director. Committee membership is effective as of May 15, 2023.13, 2024.

| |

| |

| |

| Dennis V. Arriola

Age: 63 Director Since: September 2022 | ConocoPhillips Committees:  |

Mr. Arriola is an Operating Partner at Sandbrook Capital. He previously served as Chief Executive Officer of Avangrid, Inc. from 2020 until 2022. He joined Avangrid from Sempra Energy, a publicly traded energy infrastructure company, where he served as executive vice president and group president, and chief sustainability officer. Throughout his career, Mr. Arriola has served in a broad range of leadership positions in gas and electric utilities as well as renewables, including as chairman, president and chief executive officer of Southern California Gas Co., senior vice president and chief financial officer of both San Diego Gas & Electric and Southern California Gas Co., vice president of communications and investor relations for Sempra, and regional vice president and general manager of Sempra’s South American operations.

Mr. Arriola serves on the board of directors of Meritage Homes, Commercial Metals Company, and the Automobile Club of Southern California. He previously served on the boards of Avangrid, Inc., the California Latino Economic Institute, the U.S. Chamber of Commerce, the California Business Roundtable, the Edison Electric Institute, and the boards of several Sempra operating companies, including Infraestructura Energética Nova, a publicly traded company in Mexico, Luz del Sur SAA, a publicly traded company in Peru, and Chilquinta Energía in Chile.

Skills and Qualifications:

Mr. Arriola’s extensive experience in the energy sector, including leadership positions in companies with global operations in gas and electric utilities as well as renewables, brings valuable perspective to the Board. The Board believes that his career experience, including in sustainability, will greatly enhance the Board’s ability to guide ConocoPhillips in executing its strategy.

Other current U.S. public company directorships:

| ● | Commercial Metals Company | |||||||

| ||||||||

| ● |  | |||||||

| CEO or senior officer |   | Financial reporting |   | Industry | |||

| Global |   | Regulatory/government |   | Public company board service | |||

| Environmental/sustainability |   | Human capital management |

22 21ConocoPhillips

Item 1: Election of Directors and Director Biographies

| |

| |

| |

| |

|

| |||||||

| ||||||||

|  |  | ||||||

| |

| |

| |

Gay Huey Evans CBE

Age: 69 Director Since: March 2013 | ConocoPhillips Committees:  | ||||||||

Ms. Huey Evans is the former Chairman of the Board of Directors of the London Metal Exchange. She is also a member of His Majesty’s Treasury Board, Sub-Committee, and Nominations Committee and a non-executive director S&P Global Inc. She also currently serves as a Senior Advisor of Chatham House, as an advisor of Quantexa, and as a Trustee of Benjamin Franklin House. She was Vice Chairman, Investment Banking and Investment Management at Barclays Capital from 2008 to 2010. She was previously head of governance of Citi Alternative Investments (EMEA) from 2007 to 2008 and President of Tribeca Global Management (Europe) Ltd. From 2005 to 2007, both part of Citigroup. From 1998 to 2005, she was director of the markets division and head of the capital markets sector at the U.K. Financial Services Authority. She previously held various senior management positions with Bankers Trust Company in New York and London.

Ms. Huey Evans previously served on the boards of IHS Markit, Itau BBA International Limited, Aviva plc, The London Stock Exchange Group plc., Falcon Private Wealth Ltd, and Standard Chartered plc. She also previously served as Trustee of the Beacon Awards, which celebrate British philanthropy and as Trustee of Wellbeing of Women, where she was Chair of the Investment Committee.

Skills and Qualifications:

Ms. Huey Evans’ in-depth knowledge of, and insight into, global capital markets from her extensive experience in the international financial services industry brings valuable expertise to ConocoPhillips’ businesses.

Ms. Huey Evans was awarded a CBE in 2021 for services to the economy and philanthropy, and an OBE in 2016 for services to financial services and diversity. She is a passionate advocate for ensuring markets build trust through accessibility and transparency and for increased diversity in business.

Other current U.S. public company directorships:

| ● |

|

| CEO or senior

| |||||||

| officer |  |  | Financial reporting |   | Global | |||

| Regulatory/government | |||||||

| Public company board service | |||||||

2023 Proxy Statement23ConocoPhillips

Item 1: Election of Directors and Director Biographies

| |

| |

| |

| |

| |

| |

Jeffrey A. Joerres

| ||||||||

Age: 64 Director Since: July 2018 | ConocoPhillips Committees:  | |||||||

Mr. Joerres served as Chief Executive Officer of ManpowerGroup Inc. from 1999 to 2014, as Chairman of the Board from 2001 to 2014, and as Executive Chairman from May 2014 to December 2015. Mr. Joerres joined ManpowerGroup in 1993 and served as vice president of marketing and senior vice president of European operations and marketing and major account development.

He currently serves on the boards of The Western Union Company and Artisan Partners Asset Management Inc. He previously served as a director of Johnson Controls International plc and Artisan Funds, Inc. Additionally, Mr. Joerres is on the board of the Green Bay Packers and Kohler Co. He is a minority owner in the Milwaukee Bucks. Mr. Joerres is a former director and Chairman of the Federal Reserve Bank of Chicago and previously served on the board of the Boys and Girls Clubs of Milwaukee.

Skills and Qualifications:

Mr. Joerres’s extensive global leadership, human capital management experience, and substantial involvement on both public and private boards enable him to provide guidance to the Board with respect to ConocoPhillips’ people and operations.

Other current U.S. public company directorships:

| ● | Artisan Partners Asset Management Inc.

|

| ● |  |

| CEO or senior officer |   | Financial reporting |   | Global | |||

| ||||||||

| Regulatory/government |   | Public company board service |   | Human capital management | |||

| |

| |

| ||||||||

| ||||||||

|  |  | ||||||

|  |  | ||||||

| ||||||||

24 23ConocoPhillips

Item 1: Election of Directors and Director Biographies

| Ryan M. Lance Chairman and Chief Executive Officer, ConocoPhillips Age: Director Since: April 2012 | ConocoPhillips Committees:  |

Mr. Lance was appointed Chairman and Chief Executive Officer in May 2012, having previously served as Senior Vice President, Exploration and Production—International since May 2009.

Mr. Lance previously served as President, Exploration and Production—Europe, Asia, Africa, and the Middle East from September 2007 to April 2009. From February 2007 to September 2007, he served as Senior Vice President, Technology, and prior to that, Mr. Lance served as Senior Vice President, Technology and Major Projects beginning in 2006. He served as President, Downstream Strategy, Integration and Specialty Businesses from 2005 to 2006.

Skills and Qualifications:

Mr. Lance’s service as Chairman and Chief Executive Officer of ConocoPhillips makes him well qualified to serve both as a director and Chairman of the Board. Mr. Lance’s extensive experience in the industry as an executive in our exploration and production businesses, and as the global representative of ConocoPhillips, makes his service as a director invaluable.

Other current U.S. public company directorships:

| CEO or senior officer |  | Industry |  | Global | ||

| Regulatory/government |  | Public company board service |  | Environmental/sustainability | ||

| Human capital management |

24 ConocoPhillips

Item 1: Election of Directors and Director Biographies

| Timothy A. Leach

| |||||||

Age: 64 Director Since: January 2021 | ||||||||

Mr. Leach was appointed Advisor to the Chief Executive Officer for ConocoPhillips in May 2022. He previously served as executive vice president, Lower 48. Prior to joining ConocoPhillips, Mr. Leach served as chairman and chief executive officer of Concho Resources Inc. from its formation in February 2006, until its acquisition by ConocoPhillips in January 2021. During his time at Concho, Mr. Leach also served as president from July 2009 until May 2017.

Mr. Leach previously served as an appointed member of the Texas A&M University System Board of Regents from 2017 to 2023 and served as chairman from 2021 to 2023.

Skills and Qualifications:

Mr. Leach brings invaluable contributions to the Board with his extensive industry experience and valuable expertise in strategic leadership of a public company.

| CEO or senior officer |   | Financial reporting |   | Industry | |||

| ||||||||

| Regulatory/government |   | Public company board service |   | Environmental/sustainability | |||

| Human capital management | |||||||

Item 1: Election of Directors and Director Biographies | |

| |

| |

| William H. McRaven

| |||||||

Age: 68 Director Since: October 2018 |

| |||||||

William H. McRaven is a Senior Advisor at Lazard Financial. He is also a retired U.S. Navy Four-Star Admiral (SEAL) and the former Chancellor of the University of Texas System. During his time in the military, he commanded special operations forces at every level, eventually taking charge of all U.S. Special Operations. His military career included combat during Desert Storm and both the Iraq and Afghanistan wars. As the Chancellor of the University of Texas System from January 2014 until May 2018, he led one of the nation’s largest and most respected systems of higher education, with over 230,000 students and 100,000 faculty, staff, and health care professionals.

Admiral McRaven is a recognized national authority on U.S. foreign policy and has advised Presidents George W. Bush and Barack Obama and other U.S. leaders on defense issues. He currently serves on the advisory boards of Palantir Technologies Inc. and Haveli Investments. He also serves on the Council on Foreign Relations, the National Football Foundation, the International Crisis Group, and The Mission Continues.

Skills and Qualifications:

Admiral McRaven’s international, logistical, and administrative experience brings valuable expertise on global business issues and government relations to the Board.

| CEO or senior officer |   | Financial reporting |   | Global | ||||

| Regulatory/government |   | Human capital management | ||||||

2023 Proxy Statement25ConocoPhillips

Item 1: Election of Directors and Director Biographies

| |

| |

| |

| Sharmila Mulligan

| |||||||

Age: 58 Director Since: July 2017 | ConocoPhillips Committees:  | |||||||

Ms. Mulligan served as the Chief Strategy Officer at Alteryx from April 2019 to August 2021 following the company’s acquisition of ClearStory Data, where she served as founder and chief executive officer since its inception in September 2011. From 2009 to 2011, Ms. Mulligan served as executive vice president for Aster Data Systems, Inc. until its acquisition by Teradata Corporation. Prior to Aster Data, Ms. Mulligan was a vice president of software solutions for HP Inc. Prior to HP, Ms. Mulligan was executive vice president of products and marketing at Opsware Inc. from 2002 until its eventual acquisition by HP in 2007. Prior to Opsware Inc., Ms. Mulligan led product management and held vice president positions at Netscape Communications, Microsoft, and General Magic.

Ms. Mulligan serves on the advisory board and board of visitors of Northwestern University and the University of Richmond and is an advisor to, and investor in, numerous enterprise software and consumer technology companies. Ms. Mulligan previously served on the board of directors of Lattice Engines, Inc. until its acquisition.

Skills and Qualifications:

Ms. Mulligan’s experience in cloud computing, scalable data analytics, and a broad range of big data technologies plus Internet of Things and Artificial Intelligence innovation adds exceptional value to the Board. Her experience as a CEO enables her to provide the Board with beneficial strategic leadership qualities.

| CEO or senior officer |   | Financial reporting |   | Technology | ||||

| Human capital management | ||||||||

| |

| |

| |

| |

| ||||||||

| ||||||||

|  |  | ||||||

|  |  | ||||||

| ||||||||

26 27ConocoPhillips

Item 1: Election of Directors and Director Biographies

| Eric D. Mullins Chairman and Chief Executive Officer, Lime Rock Resources Age: Director Since: September 2020 | ConocoPhillips Committees:  |

Mr. Mullins is Chairman and Chief Executive Officer of Lime Rock Resources, a private equity fund that he co-founded in 2005. He previously served as co-chief executive officer of Lime Rock Resources. Lime Rock is focused on acquiring and developing low-risk oil and gas properties. Prior to co-founding Lime Rock, Mr. Mullins served as a managing director with Goldman Sachs in the Natural Resources Group from 1999 to 2004, as vice president from 1994 to 1999, and as an associate from 1990 to 1994.

Mr. Mullins serves on the board of directors for Valero Energy Company. He also serves as vice chair on the board of directors of the Greater Houston Partnership and on the board of trustees of the Baylor College of Medicine. Mr. Mullins previously served on the boards of Anadarko Petroleum Company, Pacific Gas & Electric Company, PG&E Corporation, and LRR Energy, L.P.

Skills and Qualifications:

Mr. Mullins brings to the Board valuable industry experience as well as management, accounting and finance expertise. The Board believes that his career experiences and knowledge in financing and strategic matters for companies greatly assist and enhance the Board’s ability to provide effective strategic oversight.

Other current U.S. public company directorships:

|

| CEO or senior officer |  | |||||

|  | Industry | |||||

| Global |  | Public company board service |  | Environmental/sustainability | ||

| Human | ||||||

| capital management | |||||||

28 ConocoPhillips

Item 1: Election of Directors and Director Biographies

| Arjun N. Murti

| |||||||

Age: 55 Director Since: January 2015 | ConocoPhillips Committees:  | |||||||

Mr. Murti is a Partner at Veriten LLC and a Senior Advisor at Warburg Pincus. He previously served as a partner at Goldman Sachs from 2006 to 2014. Prior to becoming partner, he served as managing director from 2003 to 2006 and as vice president from 1999 to 2003. During his time at Goldman Sachs, Mr. Murti worked as a sell-side equity research analyst covering the energy sector. He was co-director of equity research for the Americas from 2011 to 2014.

Previously, Mr. Murti held equity analyst positions at JP Morgan Investment Management from 1995 to 1999 and at Petrie Parkman from 1992 to 1995.

Mr. Murti serves on the advisory board of ClearPath, Columbia Center on Global Energy Policy, and as a trustee of Kent Place School.

Skills and Qualifications:

Mr. Murti brings to the Board a deep understanding of financial oversight and accountability with his experience as a Partner at Goldman Sachs. He has spent more than 30 years in the financial services industry with an extensive focus, both domestic and global, on the energy industry. This experience provides the Board valuable insight into financial management and analysis.

| Financial reporting |   | Industry |   | Global | |||

| ||||||||

| Environmental/sustainability |   | Human capital management | |||||

| ||

| ||

| ||

| ||

| ||

| ||||||||

| ||||||||

|  |  | ||||||

| ||||||||

20232024 Proxy Statement27 29

Item 1: Election of Directors and Director Biographies

| |

| |

| |

Lead Director | |

Former Chairman, President and Chief Executive Officer, Age: 61 Director Since: February 2010 Lead Director Since: May 2019 | ConocoPhillips Committees:  | ||||||||

Mr. Niblock served as Chairman of the Board and Chief Executive Officer of Lowe’s Companies, Inc. from January 2005 until July 2018 and as President of Lowe’s from 2011 until July 2018, after having served in that role from 2003 to 2006. Mr. Niblock became a member of the board of directors of Lowe’s when he was named Chairman-and CEO-elect in 2004. Mr. Niblock joined Lowe’s in 1993 and during his career with the company, he also served as vice president and treasurer, senior vice president, and executive vice president and CFO. Before joining Lowe’s, Mr. Niblock had a nine-year career with accounting firm Ernst & Young.

Mr. Niblock serves on the board of directors of Lamb Weston Holdings, Inc. and PNC Financial Services Group, Inc. He previously served as a member of the board of directors of the Retail Industry Leaders Association from 2003 until 2018 and served as its secretary from 2012 until 2018. He also served as its chairman in 2008 and 2009 and as vice chairman in 2006 and 2007.

Skills and Qualifications:

The Board values his experience as a CEO and in financial reporting matters. Mr. Niblock’s experience as a CEO of a large public company allows him to provide the Board with valuable operational and financial expertise.

Other current U.S. public company directorships:

| ● | Lamb Weston Holdings, Inc. | |||||||

| ||||||||

| ● |  | |||||||

| CEO or senior officer |   | Financial reporting |  | ||||

|  |   | Public company board service | |||||

| ||||||||

|  | Human capital management | ||||||

Item 1: Election of Directors and Director Biographies

| David T. Seaton Former Chairman and Chief Executive Officer, Fluor Corporation Age: Director Since: March 2020 | ConocoPhillips Committees:  |

Mr. Seaton is the former Chairman and Chief Executive Officer of Fluor Corporation. He became CEO and joined Fluor’s board of directors in February 2011 and was elected to the role of Chairman of the board in February 2012. Mr. Seaton held numerous positions in both operations and sales globally since joining the company in 1985.

Mr. Seaton serves on the board of directors of The Mosaic Company and the National Association of Manufacturers. He also serves as a senior advisor for the Boston Consulting Group’s Infrastructure Practice and 8VC Enterprises LLC. He has served in leadership positions of numerous business associations, including the Business Roundtable, the International Business Council, the American Petroleum Institute, and the U.S.-Saudi Arabian Business Council. In 2011, he was appointed by the U.S. Secretary of Energy to serve as a member of the National Petroleum Council.

Mr. Seaton is the former chairman of the National Board of Governors of the Boys and Girls Clubs of America, and previously served in leadership positions for the Boys and Girls Clubs of America and United Way of Greater Dallas.

Skills and Qualifications:

As a former CEO of a multinational engineering and construction company, Mr. Seaton brings valuable experience and expertise in operational and financial matters. The Board believes Mr. Seaton’s international business experience with global issues facing a large, multinational public company make him well qualified to serve as a member of the Board.

Other current U.S. public company directorships:

|

| CEO or senior officer |  | |||||

|  | Industry | |||||

| Global |  | Regulatory/government |  | Public company board service | ||

|  | Human capital management |

2024 Proxy Statement 31

Item 1: Election of Directors and Director Biographies

| R.A. Walker

| |||||||

Age: 67 Director Since: March 2020 | ConocoPhillips Committees:  | |||||||

Mr. Walker was the Chairman and Chief Executive Officer of Anadarko Petroleum Corporation until August of 2019, when the company was purchased by Occidental Petroleum. He joined Anadarko in 2005 as senior vice president and chief financial officer, later serving as president and chief operating officer, before becoming CEO in 2012. Prior to his time at Anadarko, he worked in the oil and gas industry, investment and commercial banking, and as an institutional investor.

Mr. Walker is currently senior advisor of Jefferies Financial Group Inc. He previously served on the board of directors of BOK Financial Corporation, CenterPoint Energy Corporation, Enable Midstream Partners, LP, and Health Care Services Corporation.

Skills and Qualifications:

In addition to his former role as Chairman and CEO of Anadarko, Mr. Walker has significant energy industry, commercial and investment banking, and asset management experience, as well as technology, regulatory, governmental, and international business experiences. He has served on and chaired numerous boards of public and private companies, industry trade associations and philanthropic organizations, bringing a broad range of experience and expertise to the Board.

| CEO or senior officer |   | Financial reporting |   | Industry | |||

| Global |   | Regulatory/government |   | Technology | |||

| Public company board service |   | Environmental/sustainability |   | Human capital management | |||

| FOR | The Board recommends you vote FOReach nominee standing for election as director. |

2832 ConocoPhillips

Item 1: Election of Directors and Director Biographies

Board Composition and Refreshment

| In 2023, the Board undertook a search for qualified female candidates that could bring the right skills and experience to enhance the Board’s composition. A number of candidates have been reviewed and considered, and we are in the process of selecting the right individual, including advanced discussions with one candidate. A great deal of rigor and care is put into the Board refreshment process, which requires time for director selection and onboarding. Nonetheless, we are committed to onboarding at least one new female director by the end of 2024. |

As part of our Board’s commitment to regular renewal and refreshment:

| ● | The Committee on Directors’ Affairs routinely and on an ongoing basis assesses the Board’s composition, taking into consideration any planned retirements for the Board, as well as background and diversity (including gender, ethnicity, race, national origin, and geographic background); |

| ● | |

| We have implemented an annual Board and Committee assessment process; and | |

| ● | |

| We have adopted Corporate Governance Guidelines that state that directors generally may not stand for re-election after they reach the age of 72. |

SevenFive of the 1312 director nominees have joined the Board in the past 5 years. Forty-sixAlmost 42 percent of our director nominees are women and/or racially/ethnically diverse individuals. The average age of our director nominees is 61.563 and the average tenure of our director nominees is 5.86 years.

| Board Changes in the Past 5 Years | ||||||

| ||||||

| 4 directors have left our Board | |||||

Skills enhanced in the past 5 years

| ||||||

| CEO or senior officer experience | |||||

| Industry experience | |||||

| left our Board due to reaching retirement age |

Expertise in environmental matters and sustainability

| ||||

| Global organization experience | |||||

2024 Proxy Statement 33

Item 1: Election of Directors and Director Biographies

Director Onboarding and Education

The Board has an orientation and onboarding program for new directors and provides continuing education for all directors that is overseen by the Committee on Directors’ Affairs.

| New Director Orientation | |

The orientation program is tailored to the needs of each new director depending on his or her level of experience serving on other boards and knowledge of ConocoPhillips and the oil and gas industry. Materials provided to new directors include information on ConocoPhillips’ strategic plans, financial matters, corporate governance practices, Code of Business Ethics and Conduct, and other key policies and practices. The onboarding process includes a series of meetings with members of senior management and their staff for deep-dive briefings on ConocoPhillips’ operations and financial strategies and SPIRIT Values. In addition, the orientation program includes a visit to ConocoPhillips’ headquarters, and to the extent practicable, certain significant facilities. | |

| Continuing Director Education | |

Continuing director education is provided during portions of Board and committee meetings and is focused on topics necessary to assist them in fulfilling their duties, including regular reviews of compliance and corporate governance developments; business-specific learning opportunities through site visits and Board meetings; and briefing sessions on topics that present special risks and opportunities to ConocoPhillips. Education often takes the form of “white papers” covering timely subjects or topics. As part of the Board’s annual evaluation process, directors are asked to identify areas where they feel continuing education would be helpful. | |

| Director Education Seminars | |

Directors may attend educational seminars and programs sponsored by external organizations. ConocoPhillips covers the reasonable expenses for a director’s participation in outside continuing education approved by the Committee on Directors’ Affairs. |

34

2023 Proxy Statement29ConocoPhillips

Item 1: Election of Directors and Director Biographies

Board and Committee Evaluations

Each year, the Board performs a rigorous full Board evaluation, and each director performs a self-evaluation and an evaluation of each of his or her peers. Generally, the evaluation process described below is managed by the Corporate Secretary’s office with oversight by the Committee on Directors’ Affairs. However, the Committee on Directors’ Affairs periodically retains an independent third party to manage the evaluation process to ensure it remains as thorough and transparent as possible.

| 1 | EVALUATION | ●Formal opportunity for directors to identify potential improvements ●Solicit candid | ||||

| ||||||

| 2 | INDIVIDUAL INTERVIEWS | ●Lead Director has an in-depth conversation with each member of the Board | ||||

| ||||||

| 3 | REVIEW OF FEEDBACK | ●Lead Director reviews questionnaire and interview responses with Committee on Directors’ Affairs ●Lead Director reviews questionnaire and interview responses with full Board in executive session | ||||

| ||||||

| 4 | USE OF FEEDBACK | ●The Committee on Directors’ Affairs develops recommendations ●The Committee on Directors’ Affairs and the Lead Director identify areas for improvement of individual directors and of the Board as a whole | ||||

●The Committee on Directors’ Affairs uses the results of individual director evaluations as a part of the nomination process for the next annual meeting | ||||||

| ||||||

| 5 | CHANGES IMPLEMENTED | ●As a result of this evaluation process, the Board has strengthened its structure and procedures in the following ways over the past few years: – –provided more materials as pre-read to improve efficiencies at meetings and allow more time for discussion and deliberation; –more robust committee reports to the full Board; –individual director coaching; and –added new | ||||

In addition to participating in the full Board evaluation, members of each committee also complete a detailed questionnaire annually to evaluate how well the committee is operating and to suggest improvements. Each committee’s Chair summarizes the responses and reviews them with the members of his or her respective committee.

The Committee on Directors’ Affairs reviews these evaluation processes annually and develops any changes it deems necessary to maintain best practices.

2024 Proxy Statement30 35ConocoPhillips

Corporate Governance at ConocoPhillips

The Committee on Directors’ Affairs and our Board annually review our governance structure, taking into account any changes in Securities and Exchange Commission (the “SEC”) and New York Stock Exchange (the “NYSE”) rules, as well as current best practices. Our Corporate Governance Guidelines address the matters shown below, among others.